In addition to being against the law, wrong TRN usage harms the business community. You must learn about TRN to protect your company from suppliers who might defraud you by using phony TRNs. This will help you conduct business in the UAE ethically and securely. Therefore, in order to safely claim the value-added tax paid on purchases, VAT verification becomes crucial. This article will help you in understanding the procedure of verifying the Tax Registration Numbers (TRN) UAE and how VAT registration service in UAE can help you in operating safely in the tax environment.

VAT Registration UAE

Talk to our experts:30+ years of expertise.

Trusted advice.

What is the Tax Registration Number (TRN) UAE

The Federal Tax Authority TRN is a distinct 15-digit code. A distinct TRN number is given to each company or individual that is registered under UAE VAT. Additionally, only businesses registered under UAE VAT are able to charge VAT to clients. In the event that you are not a “registrant,” charging VAT may affect you legally. The categories of VAT supply determine how VAT is handled in commercial transactions. Customers of registrants must pay 5% VAT on taxable supplies, which include taxable goods and services.

The company’s status as a registered firm is guaranteed by the tax registration number. Businesses are also given the chance to request input tax credits. Customers can use the TRN number to verify if the company is authorized to charge VAT on supply.

The TRN, together with the company’s name and address, must appear on every invoice, bill, or receipt that the merchant creates in order to complete a transaction.

TRN Verification UAE: How to Verify a TRN

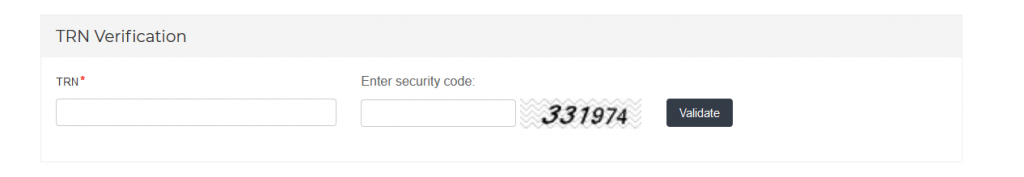

Following are the steps to be followed for TRN verification:

- Log in to the website by entering your credentials. If not have an account, you have to create one by registering.

- On the top menu, find the option “TRN Verification”.

- Enter the tax registration number you want to verify in step #3.

- After entering the captcha, click the validate button only once.

- You will get a warning, “Tax registration number does not exist in the system,” in case the TRN number is wrong. If not, the name and VAT number of that particular company will be shown in Arabic and English.

In UAE VAT returns filing, this tax registration number validation becomes an important step as an invalid TRN voids the transaction.

This is a tool that anyone can use to ensure they are only paying taxes to UAE-registered businesses and only on chargeable provisions. This tool can be used by both registered and unregistered individuals.

In the UAE, a number of companies have fake tax registration numbers. Hence, in order to escape from paying the unethical VAT, make sure to verify and check the TRN (VAT verification) mentioned on the invoice or bill. As a consumer, be sure to check the TRN number on each bill to verify the VAT specified.

FAQs on Tax Registration Number UAE

Q1. What is a Tax Registration Number (TRN) in the UAE or what is a VAT registration number in the UAE?

It (TRN number) is a unique number that acts as an identifier issued by the Federal Tax Authority (FTA) to each VAT-registered business or individual in the UAE.

Q2. How can I check the validity of TRN in UAE?

To Check business VAT number UAE:

- Login to the FTA e-services portal

- Click the TRN Verification tab at the top of the page

- Complement the TRN field

- Click Validate VAT registration UAE

Q3. Why is it important to check a TRN?

Verification of TRN is necessary to ensure compliance with UAE VAT legislation. It ensures accurate calculation of VAT, prevents fraud, and ascertains that you are dealing with a registered company. It also helps businesses maintain transparent and honest business transactions and claim input tax credits. Verification of TRN protects businesses and customers from tax evasion and other unlawful activities.

Q4. What if the TRN is invalid?

Consequences of an invalid TRN will be serious, including:

- Invalid Transactions: Any transaction with businesses having an invalid TRN may turn out to be invalid or suspicious.

- Tax Penalties: Businesses with invalid TRNs may receive penalties and fines by the FTA.

- Legal Implications: An invalid TRN may lead to possible legal consequences.

- Loss of Input Tax Credit: You cannot claim input tax credit on doing business with a company that has an invalid TRN.

Q5. How do businesses use TRN for VAT return filing?

The businesses in the UAE file their VAT returns electronically through the FTA’s Emarat ax portal using their TRN. The TRN identifies the business, which enables accurate processing and assessment of the VAT return. A business prepares its VAT return by inputting sales, purchases, and input VAT, then submits it electronically. Any due VAT is paid by the business through an authorized channel.

VAT Registration UAE

Talk to our experts:30+ years of expertise.

Trusted advice.

The UAE VAT Registration will Help to Verify the TRNs of your Business and your Clients

Validate TRNs to protect your transactions and stay clear of potential risks with ease. By verifying TRNs, you can prevent fraud, ensure accurate VAT calculations, and make your business processes much smoother. Ready to get started? Register now for VAT Registration UAE to access these essential tools and services, all of which are designed to facilitate smooth operations for your company and compliance with the tax.

Also Read: How to Calculate VAT in UAE