Cancel VAT TRN UAE: Why VAT Deregistration Matters

VAT deregistration (or cancellation of a VAT TRN in the…

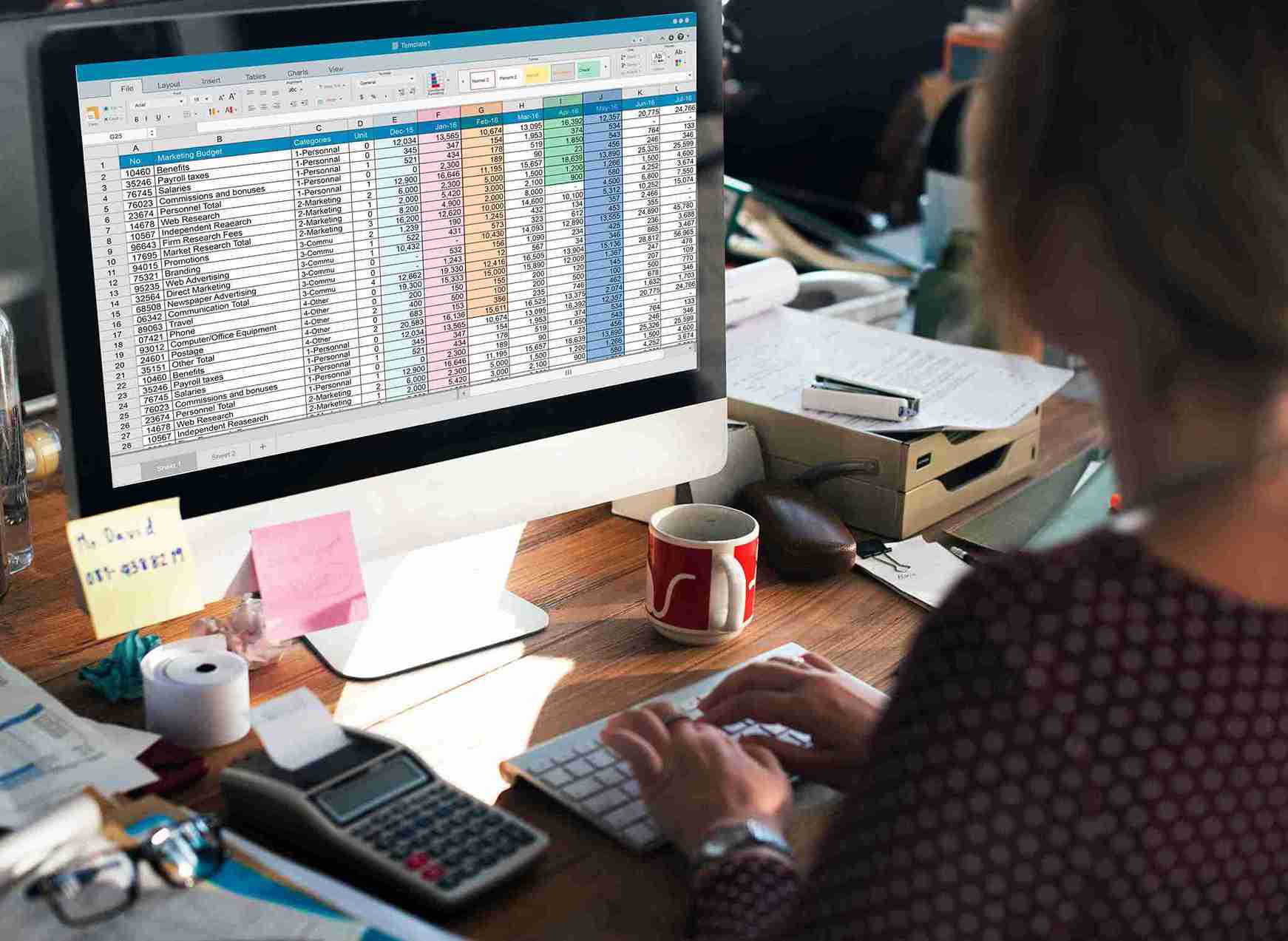

Value Added Tax or VAT is a tax on the consumption or use of goods and services. VAT is charged at each step of the “supply chain”. Businesses collect and account for the tax on behalf of the government. VAT was introduced in the United Arab Emirates (UAE) on 1st January 2018 at a standard rate of 5%. This tax is levied on most goods and services, and therefore, VAT accounting is a must for businesses in the region. Since VAT accounting in UAE is quite difficult and demands a high level of documentation and data analysis it is crucial to seek the help of a professional VAT consultant in order to get it right.

When it comes to VAT accounting in Dubai and UAE, VAT Registration UAE is one of the most preferred names by diverse businesses across the country. The VAT accounting services in Dubai are designed to assist your business in documenting and tracking your VAT transactions and meet the requirements of the UAE VAT law.

VAT accounting is important as it ensures that the company is VAT compliant and minimizes penalties that come with violations of the UAE tax laws. Some of the VAT accounting services we offer in the UAE include:

VAT accounting means recording and reporting VAT on taxable transactions. Business receive VAT on sales, or output tax, and pay VAT on purchases, or input tax. The difference between output and input tax determines the VAT payable or refundable. Proper VAT accounting helps to ensure that businesses discharge their tax responsibilities and stay within the purview of the FTA.

VAT accounting is very important for several reasons:

There are many advantages of engaging a professional VAT accountant.

VAT accounting services we offer in the UAE are:

The application of VAT varies across industries such as real estate, healthcare, education, financial services, and e-commerce, each of which is subject to distinct provisions relating to zero-rated supplies, exempt transactions, place of supply, and input tax recovery.

Our Industry-Specific VAT Accounting Services are designed to ensure that businesses comply with the applicable VAT law by:

Through a comprehensive and industry-focused approach, we assist businesses in minimizing compliance risks, optimizing tax recovery, and maintaining full adherence to the requirements of the Federal Tax Authority.

Under the UAE VAT Law, businesses continue to make recurring VAT compliance mistakes. In 2025, the most common errors include:

Free zone companies in the UAE are subject to VAT depending on their business activity, the nature of supplies, and whether they operate inside a Designated Zone.

VAT deregistration (or cancellation of a VAT TRN in the… VAT audits in the UAE are supervised by the Federal…Cancel VAT TRN UAE: Why VAT Deregistration Matters

VAT Audits in UAE: Everything You Need to Know to Stay Compliant